AARP Life Insurance Review

After you read this AARP life insurance review you will have a better understanding of how their policies work.

If you’re a senior living in the United States you’ve most likely heard of AARP. Chances are you’ve probably seen their TV commercials or received their mailings regarding life insurance burial plans.

If you have, you’ve probably asked yourself:

Is AARP burial insurance the best for me?

If you’ve asked yourself this question, we’ll help you decide.

This article will give you an in-depth look into AARP burial insurance plans and how they work.

Here’s what we’re going to cover:

- How AARP plans work

- Three benefit options that AARP offers

- Plan 1 – Coverage Up To Age 80

- Plan 2 – Whole Life With Health Questions

- Plan 3 – Whole Life With No Health Questions

- What AARP rates are

After reading this article you should be able to determine if AARP is right for you.

AARP Has 3 Final Expense Policy Options

Altogether, AARP offers three different burial insurance benefit options.

- Level Benefit – Term Life (coverage up to $100,000)

- Simplified Issue – Whole Life coverage up to $50,000)

- Guaranteed Issue – Whole Life coverage up to $25,000)

All three plans pay out a benefit to your beneficiary to cover final expenses.

AARP is not an insurance company

To your surprise, AARP is not an insurance company. They don’t actually provide their own insurance policies.

All AARP burial insurance plans are provided by New York Life.

Essentially, AARP is a middleman when it comes to insurance.

In fact, they don’t write any of their own insurance policies.

- AARP life insurance policies are provided by New York Life.

- Health insurance is provided by United Healthcare.

- Auto insurance is provided by Hartford.

This can only leave one wondering, am I paying more than I need to for life insurance through AARP? 🤔

Since 1958 AARP has built up a huge reputation as a leading company that represents seniors.

As a result, many insurance companies want their insurance products to be endorsed by AARP.

Whichever insurance company has the deepest pockets and is willing to pay the most will win the rights to underwrite their insurance policies through AARP.

Overall, all 3 AARP burial insurance policies work differently. Below you’ll find out exactly how each policy works and what it costs.

When purchasing an AARP burial insurance policy you won’t be educated on what you are purchasing or how your policy works.

Many consumers have learned the truth the hard way about AARP’s life insurance program.

This may explain why there are so many complaints on the Consumer Affairs website.

Plan #1: Level Benefit Term Life Insurance

- Coverage options: $10,000-$100,000

- Eligible Ages: 50-74 (spouses age 45-74)

- Must be an AARP member

AARP’s Term Life policy is their main life insurance plan. This is their bread and butter.

Things to know

To begin with, this is a term life insurance policy. Term life insurance expires after a certain amount of time.

For example, a 10-year term policy will expire after 10 years.

If you try to renew the policy, you find out that the once-affordable premiums have gone up by double the amount.

This is because you are now 10 years older than you were when you first got the policy.

Coverage Ends at Age 80

⬆ The image above is from AARP’s website ⬆

You will be surprised when you turn 80 years old and find out that your life insurance policy that you thought would cover you for life has ended.

Yes, this means that you are no longer insured.

In their eyes, you are too old and you are a financial liability to them.

So what happens to all those premiums you paid? You don’t get anything back.

What are your options at this point?

At this point, you won’t be eligible for term insurance anymore because of your age.

You can purchase a Whole Life burial policy with another insurance company. It will be more expensive because of your age, but it IS possible to get life insurance after 80.

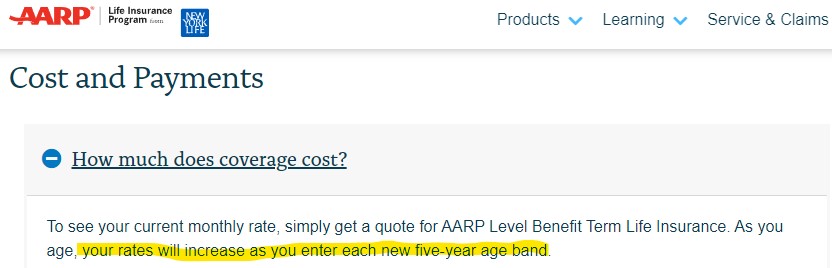

Premiums Increase Every 5 Years

As you can see from the screenshot above taken directly from their website, your rates will increase every 5 years.

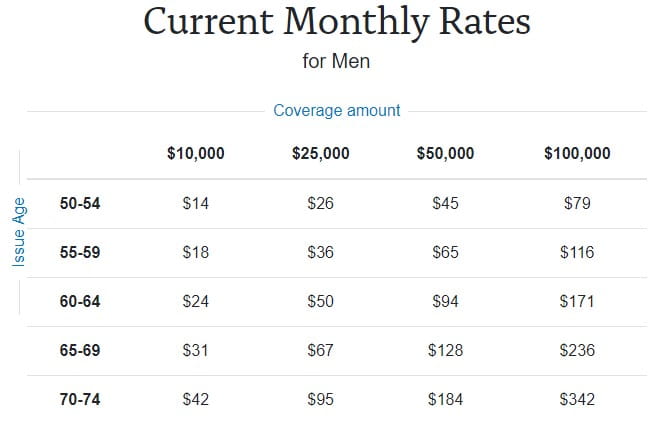

Term Insurance Rates

Would you like to know the rates for their Term Insurance policies?

Don’t worry. We took the liberty of getting the rates directly from AARP’s website.

Below you’ll see their rates. You’ll also see for yourself how their rates increase every 5 years.

To find the rate for your age, find your age range on either chart for men or women.

Then find the coverage amount and you will see the rate.

You’ll see that once you get older and fall into the next 5-year age band your price will increase.

This price increase will happen every 5 years until you turn age 74. Once you turn 80 years old you are no longer covered.

As you can see, the level benefit is not so level. It’s more like a variable benefit.

So why do they call it a level benefit?

The term Level benefit is used by the majority of life insurance companies to describe a fixed premium that doesn’t increase over time.

It looks like AARP is using the term ‘Level Benefit’ to describe that the death benefit has a fixed level premium.

As can be seen above in their price chart, the premiums are not fixed at all.

Indeed, this is a misleading marketing tactic. Shame on them. 😐

To clarify, level benefit means that the death benefit will remain the same for the full length of your coverage.

In other words, the death benefit will not decrease.

Conclusion

Given these points, you may decide that AARP term life insurance isn’t the best plan for your final expense needs.

Let’s recap:

- Their premiums increase every 5 years

- Term life insurance is temporary and most people outlive term policies

- Benefits end at age 80

- The premiums on AARP’s term insurance increase by 50% or more when you renew the policy

We understand that some people insist on having term insurance instead of a whole life policy.

If you’d rather have term life insurance, you may want to consider another company where:

- Your benefits don’t end at age 80

- The price doesn’t increase every 5 years

Plan #2: AARP Permanent Life Insurance

- Coverage amounts: $5,000-$50,000

- Eligible Ages: 50-80 (spouses age 45-80)

- Must be an AARP member

If you call AARP to get a life insurance policy, they will most likely sell you their term life policy.

They won’t tell you about their permanent whole-life policy unless you specifically ask for it.

Kind of like the secret menu at In-n-out burger.

Simple To Understand Whole Life Insurance

AARP’s permanent whole life insurance is simple to understand:

- Premiums are guaranteed never to increase

- The death benefit is guaranteed to never decrease

- The policy is guaranteed to never expire (as long as premiums are paid)

- No medical exam is required (just answer some health questions and pass a prescription history check)

In a nutshell, this policy works just like any other whole life insurance policy.

Once your first premium is paid the policy is issued and placed in force.

When you pass away, your family receives the death benefit to cover your cremation or burial and final expenses.

How to Qualify for AARP Permanent Whole Life Insurance

To qualify for AARP whole life insurance, you have to answer no to their health questions which include:

- Within the past 2 years have you been diagnosed, treated, tested positive, or been prescribed medication for: stroke, cancer, uncontrolled diabetes, kidney or liver disease, acquired immune deficiency (AIDS), aids-related complex, HIV, or immune disorder?

- In the past 2 years, have you been admitted or confined in a hospital, nursing home, long-term care, assisted living facility, or treatment facility?

- Have you been treated, diagnosed, prescribed medication, or had any kind of diagnostic testing within the past 3 months?

Additionally, a MIB (medical information bureau) check will be done to check any medications that you’ve been prescribed in the past 7 years.

If the MIB results come back with any medications prescribed to you in the past 7 years that are for any of the above-mentioned health conditions, your application will surely be declined.

Unfortunately, if you are declined life insurance by AARP they will have no other options available for you.

Conclusion

With the strict underwriting restrictions of New York Life, most people won’t medically qualify for AARP whole life insurance.

Health conditions that will cause denial for AARP whole life insurance:

- Congestive heart failure (CHF)

- Edema (fluid retention)

- Heart/circulatory surgery within the last 24 months

- Aneurysm

- Atrial fibrillation (AFIB)

- Blood thinners

- Blood clots

- Coronary artery disease

- Diabetes: Type I diabetes (requiring insulin) neuropathy (kidney), or retinopathy (eye)

- Lungs: COPD, asthma, chronic bronchitis, asthma, emphysema

- Liver/kidney disease

- Seizures

- Rheumatoid arthritis

- Organ transplant

- HIV/AIDS

- Alzheimer’s

- Many, many more

Final expense life insurance was designed for seniors. Those who are healthy and those with health conditions.

But, AARP whole life insurance is for people with almost NO health conditions.

If you are a senior with health conditions AARP will most likely deny you coverage.

Who will insure me?

At Final Expense of America, we specialize in helping seniors who have health conditions.

We work with final expense insurance companies that will usually cover you with moderate and even in some cases, severe health issues.

We’ve helped several hundreds of seniors get insured who have some of the above-mentioned health conditions.

Plan #3: AARP Guaranteed Acceptance Life Insurance

- Coverage amounts: $2,500-$25,000

- Eligible Ages: 50-80 (spouses age 45-80)

- Must be an AARP member

This guaranteed acceptance whole life insurance policy from AARP has no health questions and has a max death benefit amount of $25,000.

If you are within the eligible age range and an active AARP member, acceptance of your application is guaranteed.

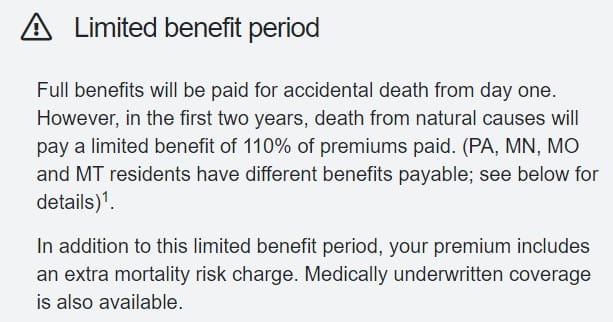

Please keep in mind, that this policy has a 2-year waiting period.

Why is that?

All life insurance policies that don’t ask any health questions will have a 2-year waiting period.

Without answering any health questions, the company has no way of knowing your health condition.

The best way for them to protect themselves financially is to give you a guaranteed acceptance policy with a 2-year waiting period.

Reasons a guaranteed acceptance policy is right for you:

- You’ve been declined for life insurance

- You have severe health issues

- You have a terminal illness.

The best thing about this policy is that no one can be denied.

For seniors in optimal health or even moderate health, the AARP guaranteed acceptance life insurance policy is not for you.

How this policy works

This is a whole life insurance policy. It is intended to work like any other whole life policy:

- There is no medical exam

- Rates are locked in and never increase

- Benefits never decrease

- The policy remains in force until you pass (as long as premiums are paid)

- Death benefits are paid to the beneficiary tax-free

Are you wondering how the 2-year waiting period works?

If death occurs within the first two years of the policy, the insurance company will reimburse 100% of the premiums paid into the policy. An additional 10% will be paid on top of that.

If it occurs as a result of an accident New York Life will pay 100% of the death benefit from day one (no 2-year waiting period).

Don’t take our word for it. See the screenshot below for yourself directly from AARP’s website. ⬇

Let’s take a look below at the rates for AARP’s guaranteed issue policy.

AARP Guaranteed Acceptance Life Insurance Rates

| Male Age: | $5,000 | $10,000 | $15,000 | $25,000 |

| 50 | $32 | $63 | $93 | $155 |

| 55 | $35 | $69 | $102 | $169 |

| 60 | $41 | $80 | $120 | $199 |

| 65 | $46 | $91 | $136 | $225 |

| 70 | $55 | $108 | $161 | $268 |

| 75 | $62 | $123 | $184 | $306 |

| 80 | $73 | $145 | $216 | $360 |

| Female Age: | $5,000 | $10,000 | $15,000 | $25,000 |

| 50 | $23 | $45 | $67 | $110 |

| 55 | $27 | $52 | $78 | $129 |

| 60 | $31 | $60 | $89 | $147 |

| 65 | $37 | $72 | $107 | $177 |

| 70 | $44 | $87 | $130 | $215 |

| 75 | $51 | $100 | $149 | $248 |

| 80 | $57 | $112 | $167 | $278 |

Conclusion

Here’s the good, the bad, and the ugly about AARP’s guaranteed acceptance policy.

The good.

The only good thing is that you have nothing to lose with this policy.

If you pass away within the 2-year waiting period your beneficiaries will receive 110% of the premiums paid into the policy.

If you pass away after the 2-year waiting period your beneficiaries will receive the full death benefit.

The bad.

You’re pretty much taking a gamble with this policy hoping that you make it past the 2-year waiting period.

The ugly.

If you don’t make it past AARP’s two-year waiting period your policy won’t pay out to your beneficiaries.

If this happens, your family will have to pay your funeral expenses out of pocket.

This can cause a financial burden on them.

Final expenses after someone passes away may include funeral services and after-death expenses. These can include medical bills and any remaining debts.

Can you find the same type of policy somewhere else cheaper? Yes.

Many people are led to believe that all burial insurance policies have a 2-year waiting period. This is definitely not true.

We can help you find a policy that doesn’t have a 2-year waiting period (depending on your health).

Get A Free Policy Review

As a complimentary service, we offer a free service to anyone who has a policy with AARP or any other company called a policy review.

We’ll review your current burial insurance policy for the following:

- Do you have the right type of policy for your particular age and health condition?

- There are 3 health tiers. Are you in the correct tier for your health condition?

- Does your policy expire?

- At what age does it expire?

- Do your premiums increase? (increasing premiums)

- Does your death benefit decrease? (decreasing benefits)

- Are you overpaying for your policy?

We do hundreds of policy reviews every year.

And, we’ve discovered that many people who thought they had whole life insurance had term insurance.

Get in touch with our customer service team to get a free review of your current policy.

There is no obligation for using this service. And if your policy is everything that it should be, we will let you know that you have a good policy and leave it as is.